Billy's Crystal Stores Inc. Has Assets of

1 Answer to Billys Crystal Stores Inc. A firm wishes to maintain an internal growth rate of 45 percent and a dividend payout ratio of 60 percent.

Billy S Crystal Stores Inc Has Assets Of 5 160 000 And Turms Over Its Assets 2 1 Times Per Homeworklib

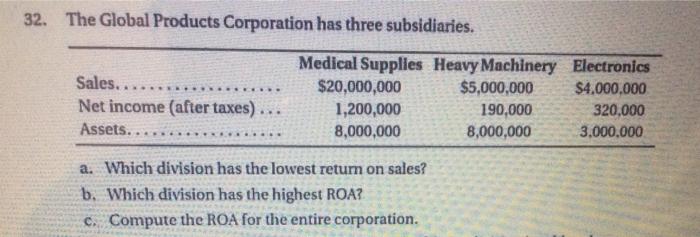

Has assets of 5960000 and turns over its assets 19 times per year.

. Billys Crystal Stores Inc. Billys Crystal Stores Inc. Billys Crystal Stores Inc.

Has assets of 5960000 and turns over its assets 19 times per year. Return on assets is 4 percent. Return on assets is 7 percent What is the firms profit margin return on sales.

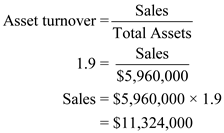

Do not round intermediate calculations. Return on assets is 8 What is. Return on assets is 8 percent.

Has assets of 5960000 and turns over its assets 19 times per year. Return on assets is 8 percent. Billys Crystal Stores Inc.

Solutions for Chapter 3 Problem 4P. Has assets of 5980000 and turns over its assets 27 times per year. Return on assets is 8.

Return on assets is 8. The return on assets is 8 percent. What is the firms profit marginReturn on sales.

What is the firms profit margin return on sales. What is the firms profit margin return on sales. Billys Chrystal Stores Inc has assets of 5000000 and turns over its assets 12 times per year.

On January 1 Year 2 Billy permanently installed new overhead lighting fixtures at a cost of 2000. What is the firms profit margin return on salesView Solution. Has assets of 5960000 and turns over its assets 19 times per year.

Return on assets is 8 percent. Billys Crystal Stores Inc. Has assets of 5360000 and turns over its assets 23 times per year.

Has sales of 11898 total assets of 9315 and a debt-equity ratio of 55. Return on assets is 8 percent. What is the firms profit margin return on sales.

Billys Crystal Stores Inc. 1 Billys Chrystal Stores Inc has assets of 5960000 and turns over its assets 19 times per year. Return on assets is 8 percent.

Has assets of 5960000 and turns over its assets 19 times per year. Billys Chrystal Stores Inc has assets of 5000000 and turns over its assets 12 times per year. Has assets of 5960000 and turns over its assets 19 times per year.

Has assets of 5960000 and turns over its assets 19 times per year. What is the firms profit margin return on sales. Input your answer as a percent rounded to 2 decimal places.

32Billys Crystal Stores Inc. Return on assets is 8 percent. What is the firms profit margin return on sales.

Has assets of 5960000 and turns over its assets 19 times per year. If its return on equity is 14 percent what is its net income. Billy s Crystal Stores Inc has assets of 5.

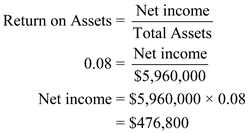

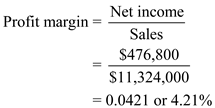

3 pts Assets Turnover Sales 5960000 19 11324000 Assets Return on Assets Net Income 5960000 8 476800 Net Income Sales Profit Margin 476800 11324000 421. Return on equitynet incometotal equitynet incomenet salesnet salestotal assetstotal assetstotal equity Return on equity -5 15 12 -90 Lionel Inc has current assets of 623122 including inventory of 241990 and current liabilities of 378454. This problem has been solved.

Return on assets is 8 percent. Return on assets is 8 percent. Billys Crystal Stores Inc.

Do not round Intermediate calculations. Chapter 3 Financial Analysis 1 Profitability ratios LO2 Billys Crystal Stores Inc. Billys Crystal stores Inc.

Profitability ratios LO2 Billys Crystal Stores Inc. See the answer See the answer done loading. Billy s Crystal Stores Inc has assets of 5.

What is the firms profit margin return on sales. Profitability ratios LO2 Billys Crystal Stores Inc. Has assets of 5960000 and turns over its assets 19 times per year.

Return on assets is 8 percent What is the firms profit margin return on sales. Return on assets is 8 percent. Has assets of 5960000 and turns over its assets 19 times per year.

Has assets of 5960000 and turns over its assets 19 times per year. Billy has the option to renew the lease for a fourth year at 8300 per month. Return on assets is 8 percent.

Return on assets is 8 percent. Return on assets is 8 percent. Input your answer as a percent rounded to 2 decimal places.

Foundations of Financial Management 16th Edition Edit edition. Return on assets is 8. Has assets of 5590000 and turns over its assets 33 times per year.

Problem 3-4 Profitability ratios LO2 Billys Crystal Stores Inc. Billys Crystal Stores Inc. Return on assets is 8 percent.

Has assets of 5960000 and turns over its assets 19 times per year. Has assets of 5960000 and turns over its assets 19 times per year. Return on assets is 8 percent.

Billys Crystal Stores Inc. Billys Crystal Stores Inc. How much amortization expense on this leasehold improvement should Billy record for Year 2.

What is the firms profit margin return on salesView Solution. Return on assets is 7 percent. Input your answer as a percent rounded to.

Has assets of 5960000 and turns over assets 19 times per year. This problem has been solved.

Week 2 Practice Problems With Solutions Chapter 3 Financial Analysis 1 Profitability Ratios Lo2 Billys Crystal Stores Inc Has Assets Of 5 960 000 Course Hero

Solved 2 Easter Egg And Poultry Company Has 2 000 000 In Chegg Com

Week 2 Practice Problems With Solutions Chapter 3 Financial Analysis 1 Profitability Ratios Lo2 Billys Crystal Stores Inc Has Assets Of 5 960 000 Course Hero

Billy S Crystal Stores Inc Has Assets Of 5 160 000 And Turms Over Its Assets 2 1 Times Per Homeworklib

Week 2 Practice Problems With Solutions Chapter 3 Financial Analysis 1 Profitability Ratios Lo2 Billys Crystal Stores Inc Has Assets Of 5 960 000 Course Hero

W2a1 Week 2 Ac 220 Spring B 2 Database Systems Is Considering Expansion Into A New Product Line Assets To Support Expansion Will Cost 380 000 It Course Hero

Solved Billy S Crystal Stores Inc Has Assets Of 5 960 000 And T Chegg Com

Network Communications Has Total Assets Of 1 430 000 And Current Assets Of 645 000 It Turns Over Its Homeworklib

Billy S Crystal Stores Inc Has Assets Of 5 160 000 And Turms Over Its Assets 2 1 Times Per Homeworklib

Billy S Crystal Stores Inc Has Assets Of 5 160 000 And Turms Over Its Assets 2 1 Times Per Homeworklib

Week 2 Practice Problems With Solutions Chapter 3 Financial Analysis 1 Profitability Ratios Lo2 Billys Crystal Stores Inc Has Assets Of 5 960 000 Course Hero

Solved Billy S Crystal Stores Inc Has Assets Of 5 960 000 And T Chegg Com

Week 2 Practice Problems With Solutions Chapter 3 Financial Analysis 1 Profitability Ratios Lo2 Billys Crystal Stores Inc Has Assets Of 5 960 000 Course Hero

Billy S Crystal Stores Inc Has Assets Of 5 160 000 And Turms Over Its Assets 2 1 Times Per Homeworklib

Solved Billy S Crystal Stores Inc Has Assets Of 5 960 000 And T Chegg Com

Solved 2 Easter Egg And Poultry Company Has 2 000 000 In Chegg Com

Chapter 3 Financial Analysis Pdf Balance Sheet Revenue

Solved 2 Easter Egg And Poultry Company Has 2 000 000 In Chegg Com

Week 2 Practice Problems With Solutions Chapter 3 Financial Analysis 1 Profitability Ratios Lo2 Billys Crystal Stores Inc Has Assets Of 5 960 000 Course Hero

Comments

Post a Comment